Mid-Year Check Up

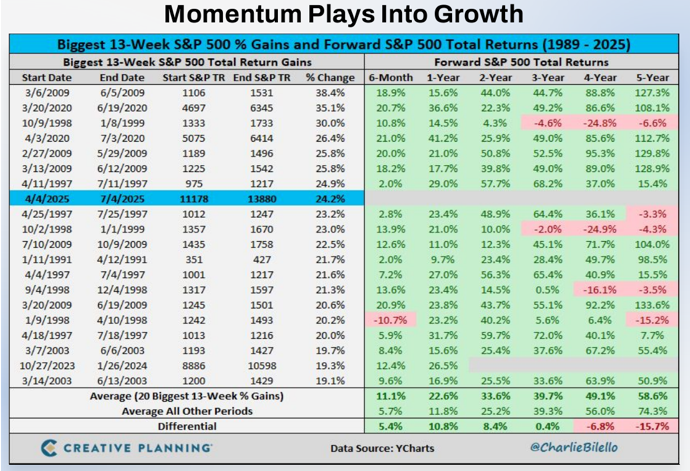

As we pass the mid point of 2025 I think it is not a stretch to say the markets have been on quite a ride this year. Early optimism turned to sharp pullbacks as the “Liberation Day” tariff announcement on April 2nd sparked widespread pullbacks in Markets across the globe. The S&P 500 officially entered “bear market” territory on April 3rd before making a low on April 7th. This was a 21% drop from the previous all-time high on Feb. 19th. The recovery from this point has been phenomenal. According to Charlie Bilello this is the second fastest recovery since the 1950’s. Only the 1982 drop reached new All-time highs faster which was within 2 months.

What about the future? As you can see in the chart below, many times in history the markets have continued to rally to new highs once the recovery is complete. The momentum tends to carry on over the following 6 months for the strongest rebounds.

What Are We Watching?

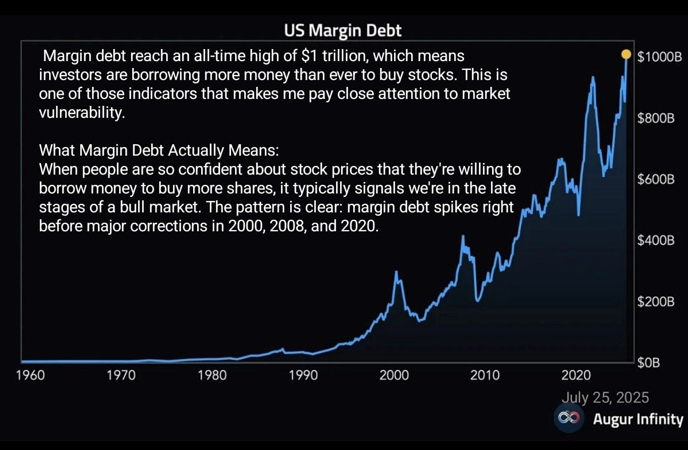

As the market continues to perform well even without interest rate cuts, FOMO (Fear of Missing Out) begins to take hold. A recent report shows US Margin Debt at an all-time high. Margin Debt represents money borrowed against stocks to purchase additional stocks. This makes the stock market particularly vulnerable to negative news. If the stock market falls slightly it could cause margin loans to be called which would result in more stocks being sold and a sharp correction could ensue.

As we move into the late stages of summer and early fall there is a high likelihood of a pull back and an opportunity to purchase stocks at lower prices.

On July 29th the Watermark Portfolio Team reduced equity exposure by 5% selling the Fidelity All In One Equity ETF in our accounts over $150,000 and put the proceeds into a short-term bond fund to wait for a pullback. This is one of a few tactical changes they have made to our client portfolios this year. Historically this has lowered volatility while still achieving our long term return goals.

The Takeaway?

Over the long term the stock markets in the US and Canada have been the best place for most people to grow their wealth. The long-term numbers are very impressive but often it is short-term thinking that leads people into underperforming the markets by a wide margin. Chasing performance, selling at the wrong time and trading without a sell discipline are a few things we see individual investors do. By working with a team including a Financial Planner and Portfolio Manager you can benefit from full-time oversight of your investments and tactical adjustments that take advantage of market opportunities whenever they occur.

DISCLAIMER

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc. This presentation/commentary does not constitute an offer to buy or sell any securities mentioned herein or solicitation to purchase these investment products, please seek advice from a professional when considering these products, including but not limited to a tax, legal and/or investment professional. All expressions of interest must be directed to Willoughby Asset Management Inc.(“WAM”) or a Harbourfront Wealth Management Inc.(“HWM”) Investment Advisor. WAM and HWM are both wholly owned subsidiaries of the same parent company, Harbourfront Wealth Holdings Inc. HWM has exclusive rights to sell WAM products. There are several risks associated with these product, including but not limited to liquidity risk, the risks are set out in greater detail in the Offering Memorandums for these products. Before investing please read the Offering Memorandums for these products. The advisor providing this presentation/commentary receives a financial benefit from selling WAM products, for more information on the fees and compensation related to the product please contact a HWM Investment Advisor for more details and read the Offering Memorandums for each product you are interested in.

Have questions about the blog? Book a call with one of our advisors today to help guide you in the right direction!