Cyber Security 2025

We are sharing our annual cybersecurity update to help keep you informed and protected. This blog includes important new information to ensure your online safety. Please take a moment to read through the details. If you have any questions, don’t hesitate to reach out. We are here to help!

Cybercriminals are constantly evolving and using new tricks, refining old ones, and getting better all the time. Their goal is simple: gain access to your sensitive data, especially banking information, and infect your devices with malicious software. They rely on deception, urgency, and human error to get through. Sometimes, all it takes is a single click on a suspicious link, a reply to a fake email, or three careless key presses to open the door. Once inside, they can monitor your activity, steal login credentials, or even lock your files for ransom.

Warning Signs to be aware of:

- Spelling errors or poor grammar

- Urgency or an attempt to evoke strong emotions.

- Numbers with an unusual amount of digits

- Links that do not match the message’s contents.

- References to something irrelevant to you

Below we have identified common scams to watch out for:

- CRA Scams: Now that the tax season has wrapped up, we are starting to see more and more scams coming from cybercriminals involving the CRA with impersonating agents, demanding immediate payments, fake websites and threatening language or threats of legal action if you don't comply. Please remember fraudsters will often use phone calls, text messages, or emails to demand immediate payment or to trick individuals into providing sensitive information, like bank details or Social Insurance Numbers. Remember that CRA will notify you via email regarding any mail communications available to you, the most recent one being your Notice of Assessment (NOA) being available and instructing you to log into My CRA Account. CRA emails will not ask you to click any links, ask for personal information, request payment by a prepaid credit card or gift card, use aggressive language or tone and they will not threaten to call the police in any emails.

- AI-Powered Scams: Scammers are using AI to create convincing phishing emails, deepfake videos, and fake voices to trick victims.

·

- Imposter Scams: Scammers pose as trusted individuals like friends, relatives, celebrities, or government officials to gain access to personal information or money.

·

- Employment Scams: Fake job listings and recruitment pitches often target job seekers with promises of high pay and minimal effort, while also requesting sensitive information or fees.

- "Accidental" Text Messages: Have you gotten a text message that seems genuine, but it also appears to be intended for someone else? It might say something like, "Sorry I'm running late, I'll be there in 15 minutes." Not wanting to be rude, you respond to tell the sender they've got the wrong number. These wrong number texts are often the first step in a romance or employment scam. Although there's sometimes a scammer on the other end from the start, scammers can also use AI messaging bots to target thousands of people at a time.

- Social Media Platforms: It can be hard to tell what is legitimate and what is not. Cybercriminals often use fake profiles to send friend requests, tricking people into clicking malicious links or sharing personal information. It is important to know that our platforms are strictly educational. Our team will not send friend requests, direct messages, or ask for personal information through social media. If you ever receive a message claiming to be from us in that way, it is not legitimate. Please always go directly to our official website www.greenprivatewealth.com or contact us directly through our verified channels.

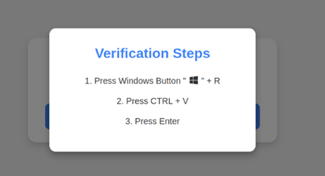

- New Scam Occurring: While browsing online, you might see a pop-up that looks like a CAPTCHA or browser error. It may say things like

“Verify you are a human” or “Fix browser issue.”

After clicking, it will ask you the following prompts. DO NOT CLICK these.

Doing this allows malware to be silently installed on your computer. If it’s too good to be true or offering free money – it’s a scam. Familiarize yourself and use extra caution.

- Travel Scams

- Fake vacation rentals: Scammers create professional-looking websites for properties that either don’t exist or are very different from their descriptions

- Fake travel agencies: Fraudsters offer vacation packages at low prices. When it comes time to travel, vacationers find their reservations aren’t valid

- Fake Travel Insurance: Fraudsters offer fake travel insurance plans that don’t provide coverage or aren't recognized by real insurers.

Best Practises:

- If something looks off, close the website immediately, do not click or interact further.

- Use strong and unique passwords for each account: Create complex passwords that are difficult to guess and avoid using the same password for multiple accounts.

- To determine if the sender is legitimate hover over the from name and the email address will pop up. Legitimate emails from us will have the greenprivatewealth.com domain in it. If it is anything different, then it is a scam, and you should call us.

- Ensure you add our email addresses to your safe sender list. This will allow your email program to flag phishing emails using our names.

- Do NOT follow pop-up instructions that ask you to press keyboard shortcuts or copy/paste anything.

- Do NOT trust pop-ups claiming to fix issues in Chrome or Safari

- Do NOT give out any personal details including address, date of birth, SIN, etc.

Our Promises and Practice

- Sharing Secure Information: We will provide a Shared Folder. A secured shared folder is a folder we will email you that is shared among you and us, but with added security features to protect its contents. This includes things like encryption, access controls, and other measures to prevent unauthorized access or modification of files within the folder. Here we will ask you to upload any documents, void cheques, statements etc.

- We will not ask you to provide sensitive personal information (like usernames, passwords, bank account numbers or SIN) over email.

- Do not try to open any shared document that you are not expecting to receive from us.

- Do not click on links or attachments from us that you do not recognize or are not expecting. Be especially wary of .zip or other compressed or executable file types.

- If you get an email saying your account is locked out, go directly to the website, and try. Do not use the link that was sent.

Contributions, withdrawals, banking or email update? We will always call to confirm the details with you. We do not accept written instructions for your safety. In our ongoing effort to ensure the security of your personal information and account, we want to inform you that you may be asked additional questions to verify your identity during future interactions with us.

Remember just staying vigilant and keeping yourself informed can make a huge difference. Please never hesitate to call us in Burlington

(905) 634-3975

or Woodstock at

519-539-8212 if you have any suspected suspicion we are here to help! We would always rather you ask and make sure!

Caryl Smith

Client Service Associate

Green Private Wealth

Have questions about the blog? Book a call with one of our advisors today to help guide you in the right direction!